Seriously! 10+ List On Is Net Income The Same As Retained Earnings Your Friends Did not Tell You.

Is Net Income The Same As Retained Earnings | Owner's equity, also called stockholders' equity, is the net worth of a company, derived by subtracting liabilities from assets. Managerial accounting is very different from financial accounting. So, when a company's management decides to retain though loans can also fund the same needs as equity (retained earnings), but. Net income, earnings, and profits are important for taxes and accounting purposes. Retained earnings provide a much clearer picture of your business' financial health than net income can.

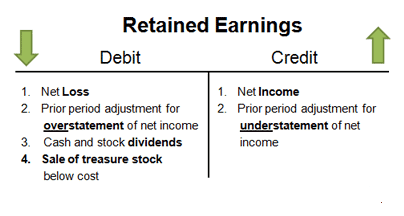

Learn about retained earnings and how retained earnings are determined. Definition of retained earnings usually, retained earnings consists of a corporation's earnings since the corporation was formed minus the amount that was distributed to the stockholders as dividends. Just like individuals save a portion of their salary to meet future contingencies, companies also do the same.companies keep a portion of their profits aside for. Retained earnings is a part of the net income or net profit retained by the company after paying a dividend to the shareholders. Net income and retained earnings are two ways to get there and the two measurements go hand in hand.

Retained earnings could in some cases be the same as net profit. Net profits or net losses are rolled into the retained earnings account when closing entries are made at the end of the notice that the total balance of stockholders equity remains the same, but retained earnings was reduced. Owner's equity, also called stockholders' equity, is the net worth of a company, derived by subtracting liabilities from assets. In other words, retained earnings is the amount of earnings that the stockholders are leaving in. Retained earnings is a part of the net income or net profit retained by the company after paying a dividend to the shareholders. Retained earnings implies that, historically, your company has had net income. What is retained by the company is a portion of net profit which is retained earnings are actually shareholders money. The amount of retained earnings that a corporation may pay as cash dividends may be less than total retained earnings for several contractual or voluntary reasons. Learn about retained earnings and how retained earnings are determined. Retained earnings, therefore, are the sum of a company's profits, after dividend payments, since the company's inception. This money is usually reinvested into the company, becoming the primary fuel for the firm's. Retained earnings provide a much clearer picture of your business' financial health than net income can. Retained earnings are the cumulative net earnings or profit of a firm after accounting for dividends.

This money is usually reinvested into the company, becoming the primary fuel for the firm's. In other words, retained earnings is the amount of earnings that the stockholders are leaving in. No, retained earnings comes after net income on the income statement. Retained earnings are listed on a balance sheet under the shareholder's equity section at the end of each accounting period. Net profits or net losses are rolled into the retained earnings account when closing entries are made at the end of the notice that the total balance of stockholders equity remains the same, but retained earnings was reduced.

Automatically generate your financial reports and view your retained earnings with a online invoicing software like debitoor. In other words, retained earnings is the amount of earnings that the stockholders are leaving in. This video discusses the difference between retained earnings and net income. No, retained earnings comes after net income on the income statement. Retained earnings implies a portion of companies net earnings that is set aside and not paid as a dividend, for the purpose of investing the amount in primary activities of the business or pay the debt. Net income, earnings, and profits are important for taxes and accounting purposes. What is retained by the company is a portion of net profit which is retained earnings are actually shareholders money. This number will be positive if the business. Yes income in balance sheet is the same amount which is calculated in income statement if there is any difference then it may be due to distribution of net income between retained earnings and dividend. For a company, net income is the. Retained earnings could in some cases be the same as net profit. This number can be positive or negative. Retained earnings is the portion of a company's net income which is kept by the company instead of being paid out as dividends to equity holders.

They are also called earned surplus current earnings (what the company has made so far this fiscal year) on a balance sheet would fall into the same section as r/e, but would. Learn vocabulary, terms and more with flashcards the time period is the same as that covered by the income statement. Retained earnings is the portion of a company's net income which is kept by the company instead of being paid out as dividends to equity holders. In other words, retained earnings is the amount of earnings that the stockholders are leaving in. Retained earnings are the accumulated net earnings of a business's profits after accounting for dividends, and are typically reinvested back into the business.

This number will be positive if the business. To calculate retained earnings add net income to or subtract any net losses from beginning retained earnings and subtracting any dividends paid to shareholders. Some times you'll see accumulated deficit on the balance sheet. This number can be positive or negative. No, retained earnings comes after net income on the income statement. Managerial accounting is very different from financial accounting. Retained earnings, therefore, are the sum of a company's profits, after dividend payments, since the company's inception. Start studying 1.4 retained earnings, balance sheet. There you learned about the overall framework of accounting, and how to prepare financial statements for investors and other people outside the company. This happens if the company didn't accrue dividends in the reporting year and lacks deferred tax liabilities. Retained earnings are not the same as shareholders' equity. Owner's equity, also called stockholders' equity, is the net worth of a company, derived by subtracting liabilities from assets. On the other hand, reserves can be understood as the part of profit earmarked to provide for business.

Is Net Income The Same As Retained Earnings: Net income and retained earnings are two ways to get there and the two measurements go hand in hand.